Manus Acquisition Thoughts

Economics of an AI Unicorn

Cleaning my holiday inbox I found an email from Manus excitedly to telling me about how they’d reached $100m in ARR. Me, someone who didn’t even know I had a Manus account! That seemed like a strange user touchpoint. Why would this news make me more likely to use or upgrade Manus? Why do I (a potential customer) care about their ARR? What a coincidence that they sent this email days before an acquisition…

This email contains some juicy data points:

Annualized ARR ($100m) and revenue ($125m)

$8.3m in November subscription revenue and $2m in non-recurring revenue

Current growth rate (20% MoM since 10/15)

Presumed past growth (from zero 8 months ago)

COGs (147T tokens, 83M VMs)

Opex (105 employees in 4 markets)

Margins

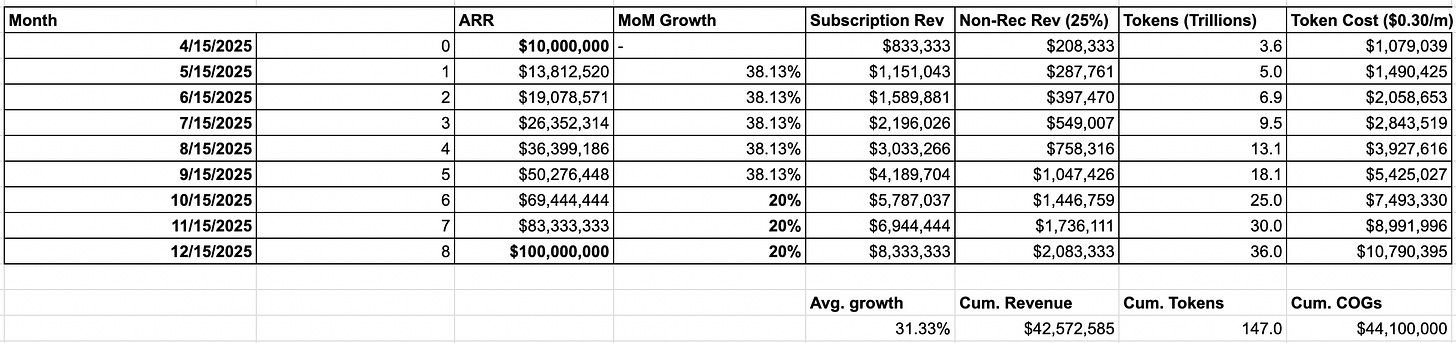

Let’s back that growth into each month with some basic facts and assumptions:

From their email: $100m ARR, 20% growth in past three months, 20% of revenue is non-recurring

Assume they had a big spike at launch (I modeled $10m in ARR in the first month)

Note: This is hugely helpful in the cumulative revenue

Assume $0.30 per million tokens and it’s only input tokens (cheaper)

-25% is not a great margin (and that doesn’t include the virtual computer cost).

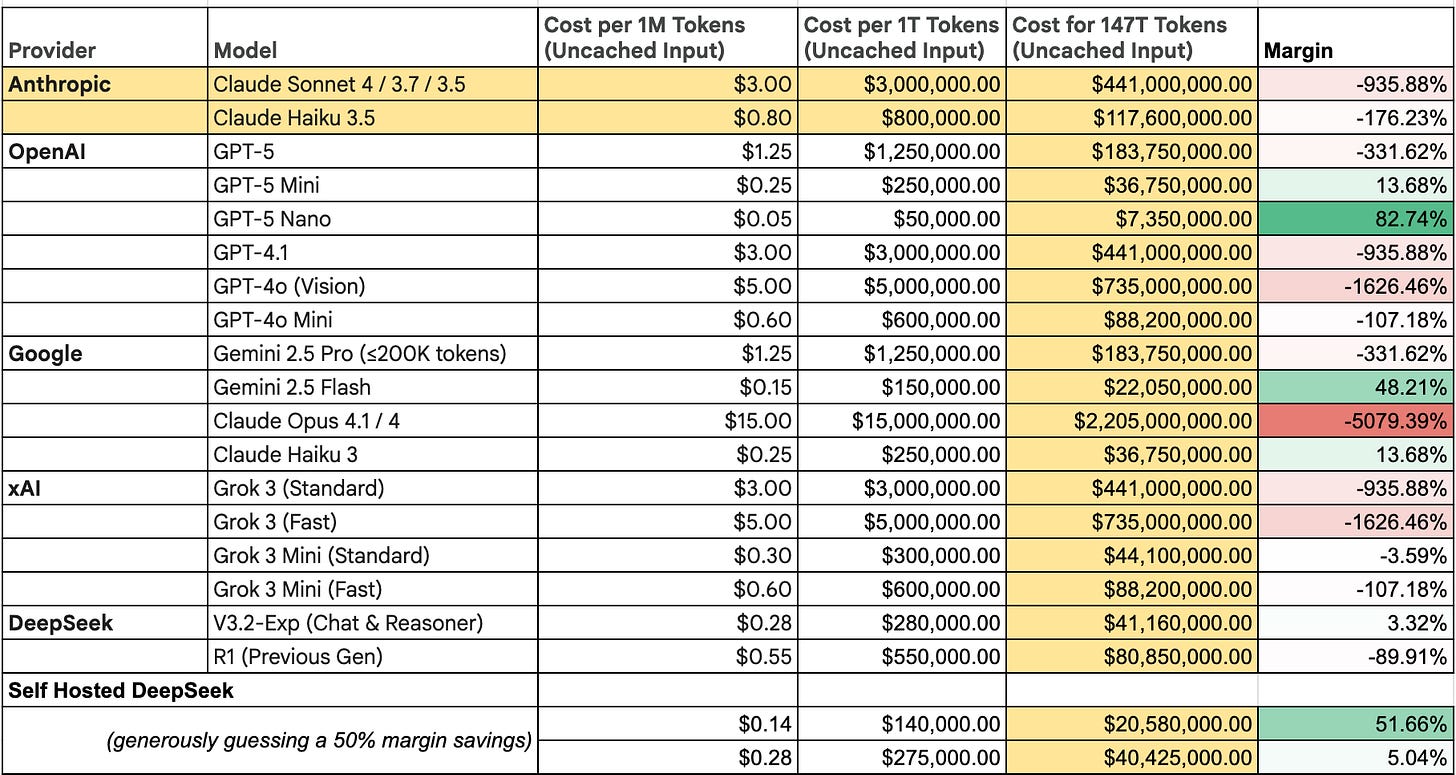

Is $0.30 per million tokens unfair? There’s room to quibble, but that’s on the relatively cheap end. The margins on top-tier models are terrifying!

Token Costs (token costs from pymnts)

Acquisition Costs

Manus is a great product with very happy customers, however they don’t appear to be a household name with viral user acquisition. I’ve seen many variants of this question from those who know Manus from their funding rather than their function:

Responses are strong endorsements of the product

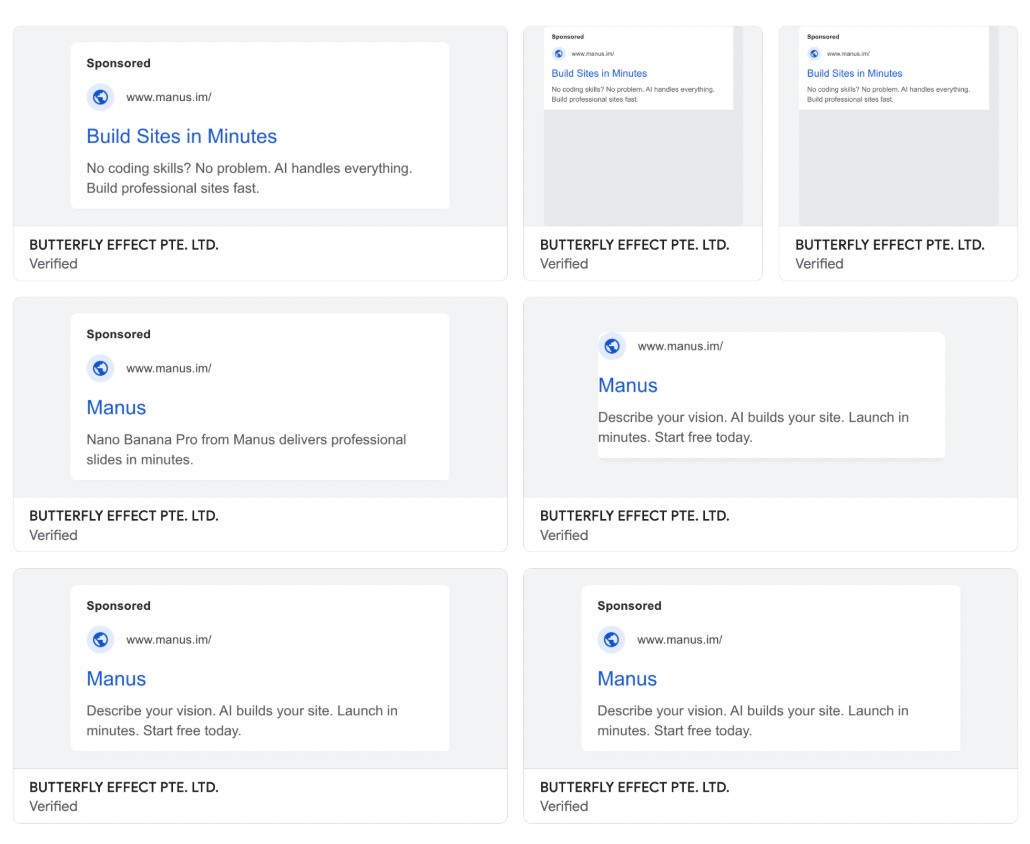

Manus seems to be relying on paid media for growth:

From meta ads transparency

From google ads transparency

These are hyper competitive marketing domains these days:

Website builders (lovable, v0, bolt, mocha, etc)

AI Slides (Gamma, Genspark, Canva, etc)

Deep Research (ChatGPT, Perplexity, etc)

I can’t imagine they are spending less than $100 per paying customer. Additionally, with the freemium model each paying customer carries the costs of the free accounts it took to convert them (likely 80-90% of accounts are free). The true CAC is likely much higher once all of that burn is accounted for.

Conclusion

My initial assumption after looking at these numbers was that their email was meant to tickle investors rather than users.

Clearly I was wrong. They were chasing Zuck Bucks! Makes total sense - Manus’s two main costs are token processing and user acquisition. Meta has the inverse problem: A model/team seeking a user application to burn tokens on and near infinite product marketing real estate to utilize.